iGaming Industry: Trueplay Market Insight

The global iGaming industry has been evolving rapidly for decades, fueled by technological advancements, regulatory changes, and a growing demand for online entertainment. This has led to fierce competition in the ever-changing industry. So how do the biggest brands stay ahead of the game? By determining what key performance indicators they should focus on and how to enhance their statistics.

This iGaming market report offers a look at the current state of the iGaming industry. It focuses on critical industry statistics such as average retention rates, visit frequency, and churn rates. Discover the financial impact of loyalty programs on gross gaming revenue (GGR) and customer retention.

Key iGaming Industry Statistics

In the global iGaming market, growth is the name of the game, so let us take a look at essential metrics gathered from iGaming brands around the world. They highlight these platforms’ performance during the first six months of operation. Doing so will provide a better understanding of the dynamics of platform performance, revenue, and player engagement for brands operating without a loyalty program.

For each metric in this iGaming market report, we measure the activity of 1,000 users on each of these platforms. Regions covered in this survey include Asia, Europe, LATAM, and North America.

Average Retention Rate

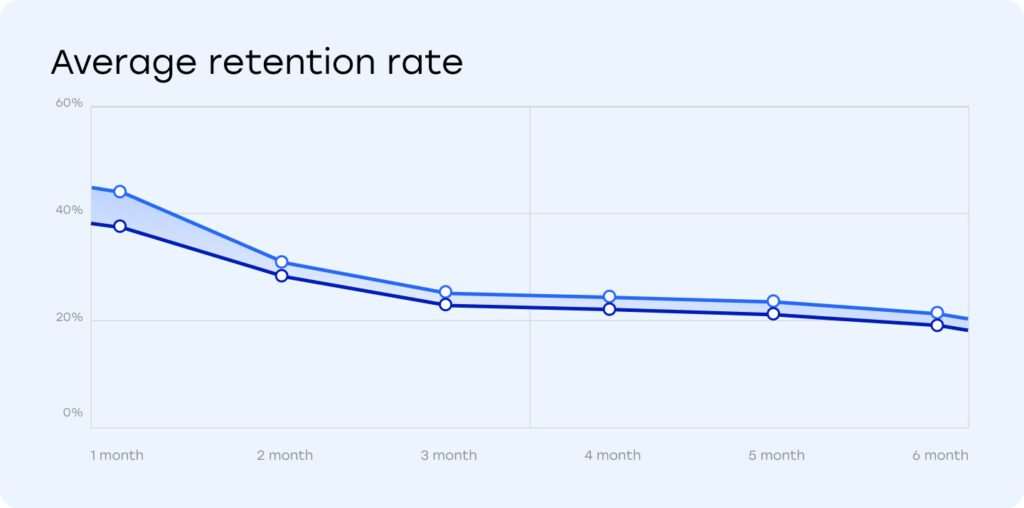

One crucial metric is the average retention rate, which shows the percentage of active players remaining on a platform over time. This is an easy way to highlight player loyalty to a brand. From our pool of players, brands saw an average retention of 39–43% (386–433 players), which slowly trickled down to 19–22% (186–215 players) by month six. This means the platforms were only able to attain half of the first month’s retention halfway through the year, a significant dent in revenue.

Fig. 1: Retention Rate

The average retention rate is also a key indicator of a platform’s overall health, reflecting the effectiveness of its engagement strategies. Looking at the chart above, you can see some stability during months three and four. Stable rates like these suggest that the platform is successful in delivering a satisfying user experience, encouraging repeat visits, and fostering a sense of community among players. An increase would further stress this point, however, we see the numbers dip even lower in subsequent months.

Frequency of Visits

This statistic offers insight into how often players engage with an iGaming platform, a vital factor for determining individual player loyalty. Here we see a frequency of 3.58% (3,576 visits) in the first month, which is already quite low but falls further to 1.98% by month four. From this point on, the frequency becomes relatively stable as month six still sees only 1.80% (1,802 visits).

Fig. 2: Frequency of visits

The stabilization of visit frequency after an initial decline is significant because it highlights a dedicated group of players that regularly return to the platform. It is to be expected that the novelty of anything eventually wears off, especially for players. Those that remain showcase the platform’s ability to maintain a loyal player base over time, but they are quite few and stagnant.

Introducing new games, tailoring promotions, and enhancing user experience are just some examples of strategies that can help maintain and even increase a platform user’s frequency of visits. Customers demand quality service and unique experiences. Provide these and the frequency of visits will undoubtedly grow, taking your brand up on the global iGaming market ladder.

Churn Rate

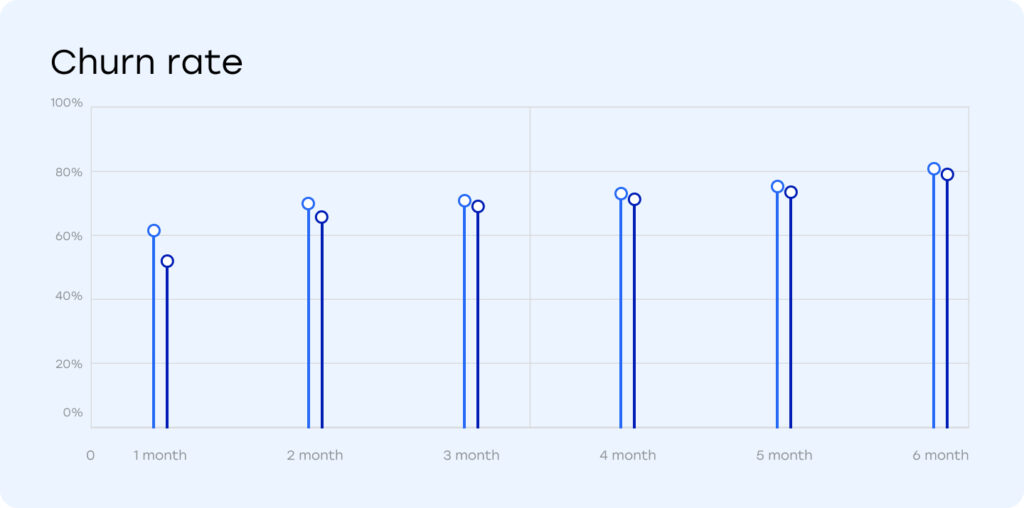

Unlike the previous statistics, used to evaluate players’ engagement with a platform, the churn rate focuses on the drop-off instead. It indicates the proportion of players that stopped playing on the platform within a certain period. This makes it a significant concern for any iGaming brand to keep an eye on.

By the end of month one, we see a significant part of players leave: 61.44%–56.75% (567–615 users). The churn rate increases incrementally by a few percent over each of the following months to settle at 81.40%–78.47% (784–814 users).

Fig. 3: Churn rate

The loss of more than half of a platform’s initial players is a big blow that indicates retention problems. Granted, this inactivity is the result of several factors, like the players’ desire to pace themselves or to check out other platforms and the games they offer.

However, a good marketing strategy will help reduce the churn rate early on, especially with special promotions for newcomers. On the other hand, a great strategy that takes into account a user’s lifetime value will have them returning once their coffers are replenished and the memory of their user experience on an iGaming platform refuses to fade.

Large churn rates early on are to be expected, but as a brand continues to engage with its players, churn will reduce. While figures like these are nothing new, there are ways to meet player demand and turn things around quickly.

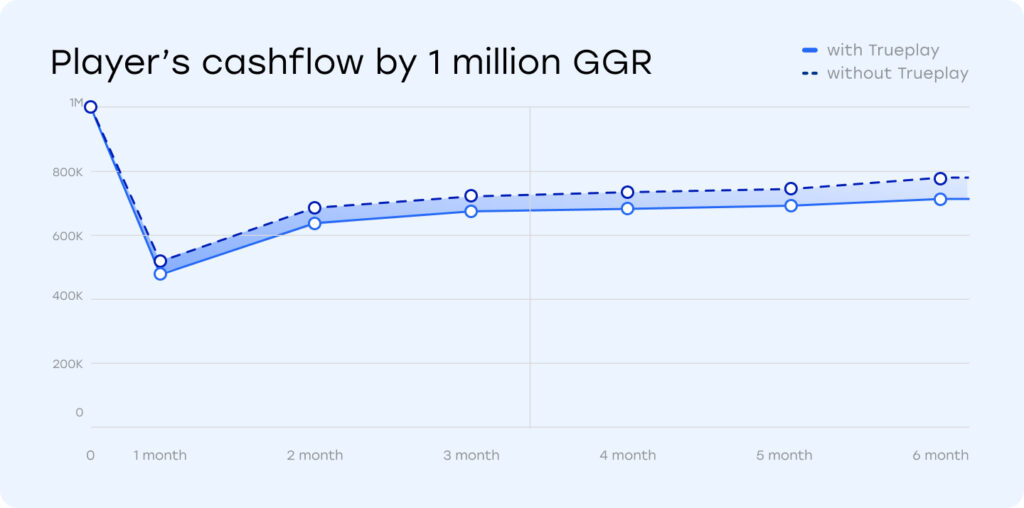

Player Cash Outflow

In the world of iGaming, player cash flow is the movement of money to and from players across the numerous platforms that exist. Deposits, withdrawals, and wins and losses are crucial to the financial health of any iGaming platform. Yet there is a fourth parameter, wagers, which is not directly a part of the flow but the main means by which brands earn and generate turnover.

Significant growth is the buzzword of the day and nothing shows this more than a player base that isn’t afraid to engage with an iGaming platform constantly. To ensure market growth, brands must improve their annual growth rate, which can be achieved via a positive player cash flow.

Fig. 4: Player cashflow

The chart above illustrates a player base that generated $1 million at the start of month one and how player churn has affected this cash flow. Despite losing about 61% of players, these brands only saw a drop of approximately 57% ($567,494.31) by the end of the month. However, later on, cash flow experienced an uptick, rising to $682,207.53 over month two and $784,722.98 by month six on these iGaming platforms.

Other Factors for Success in the iGaming Market

Technological Advancements

Human ingenuity seems to know no bounds as the time between new advancements in technology becomes shorter and shorter. Only a few decades ago, iGaming businesses had no idea that market expansion would mean internet penetration. The introduction of mobile devices also changed consumer behavior, providing the means to access iGaming platforms whenever they want.

Now we see artificial intelligence (AI) disrupting industries everywhere, while augmented reality and virtual reality provide unique experiences. iGaming brands must keep an eye on the latest technological advancements and adapt to change quickly or risk losing their market share.

Regulatory Environment

Any iGaming platform that wants to succeed must first comply with any regulatory frameworks in its region of operation. Failing to meet local regulations could swiftly lead to a federal ban, which would be detrimental to business. What’s also bad for businesses is not paying attention to the regulations in other regions as they pursue industry expansion. Meeting licensing requirements, compliance with international laws, and managing the impact of regulation changes are all important to the success of an iGaming platform.

Market Competition

Competitors are the bane and salvation of businesses everywhere. In iGaming, they keep brands on their toes, ever adapting to changes present and perceived on the horizon. To succeed, an iGaming platform must create competitive marketing strategies that can help establish good customer relations. They must also be aware of new competition as profitable markets will always have fresh entrants looking to carve a piece of key regions for themselves.

Moreover, the dynamic nature of the iGaming market demands that platforms not only innovate but also keenly analyze market trends and revenue streams. To succeed means to predict user preferences using acquired data, thereby optimizing offerings for maximum engagement and profitability. As the market grows, understanding and capitalizing on these elements becomes the key to securing a significant share of the iGaming industry’s expanding revenue.

User Experience and Engagement

Customers are the best judges of what they desire, prompting the need for successful brands to collect personal data from them. This crucial data enables the creation of personalized gaming experiences, ensuring brands meet their precise needs. However, without a user-friendly UX/UI design, players might struggle to navigate the platform, leading to a poor experience and a possible lack of valuable feedback for the platform.

UX/UI design is an important factor as it relates to customer experience, and only with a good experience will they choose to engage with a platform. Adopting AI in games and data analysis will further enhance user experience. Even so, brands must comply with privacy and data protection regulations, balancing innovation with responsibility.

There are so many factors affecting brands and their iGaming revenue beyond the few mentioned above. Some key players of the iGaming industry choose to innovate, while others put internet penetration, responsible gaming, economic trends, and even user penetration first. While brands are in it to make money, what matters most is making players, their customers, happy and hungry for more.

Boost Retention and Accelerate Growth with Trueplay

Retention and growth go hand in hand in the iGaming industry, so it makes sense to find a solution equipped to improve both. Trueplay is built from the ground up to do just that, providing a gamified experience for users.

Trueplay is the iGaming industry’s growth and retention toolbox with a handful of features that will see your bottom line soaring. By creating custom loyalty tokens, brands can reward their user’s engagement in ways that will make both parties achieve their goals.

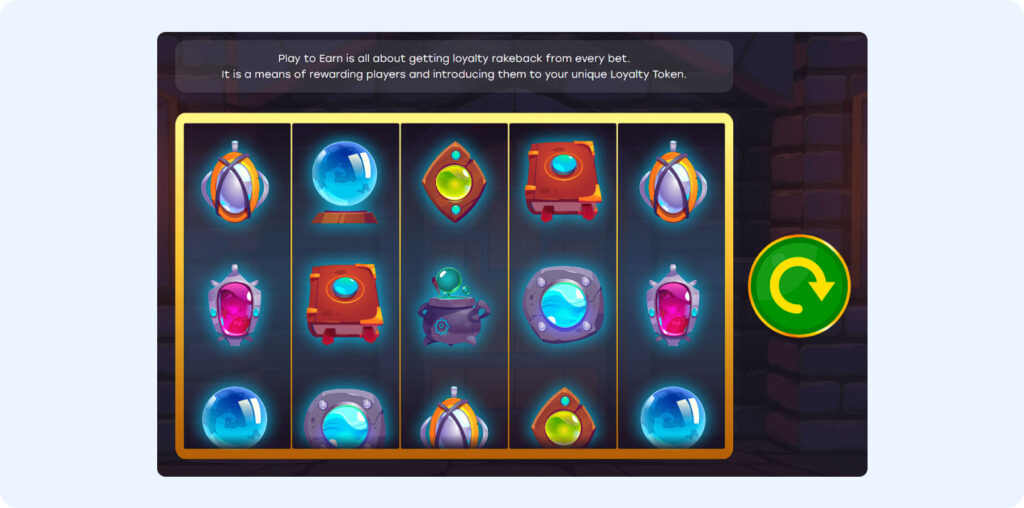

Play to Earn

The first feature is Play to Earn and as the name suggests, it allows players to gain rewards for simply playing games on the client’s platform. It ensures that every visit is rewarded, incentivizing players to keep playing regularly.

Fig. 6: Play to Earn

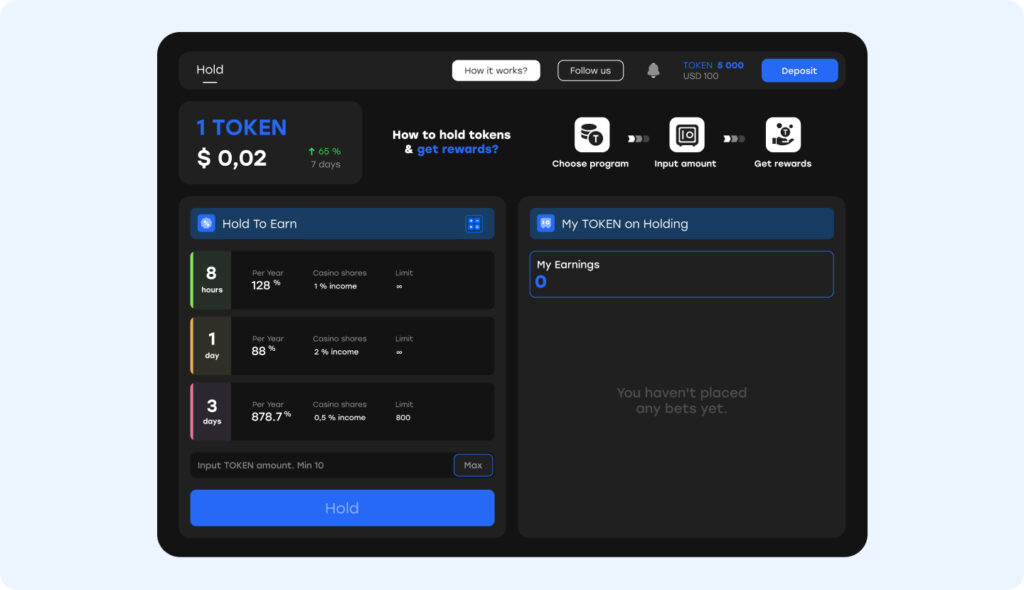

Hold to Earn

The second is Hold to Earn, a feature that allows players to freeze their tokens in the hopes of earning more after a set time period. The user gets to choose how long this period will be, from 8 hours to 1 or 3 days. Once the time has elapsed, users retrieve their frozen tokens along with any rewards they may have earned. Whether they win additional tokens depends on how well the platform did (GGR) during the Hold to Earn session. This way, players earn alongside the platform — a win-win scenario that both parties would be happy to follow.

Fig. 7: Hold to Earn

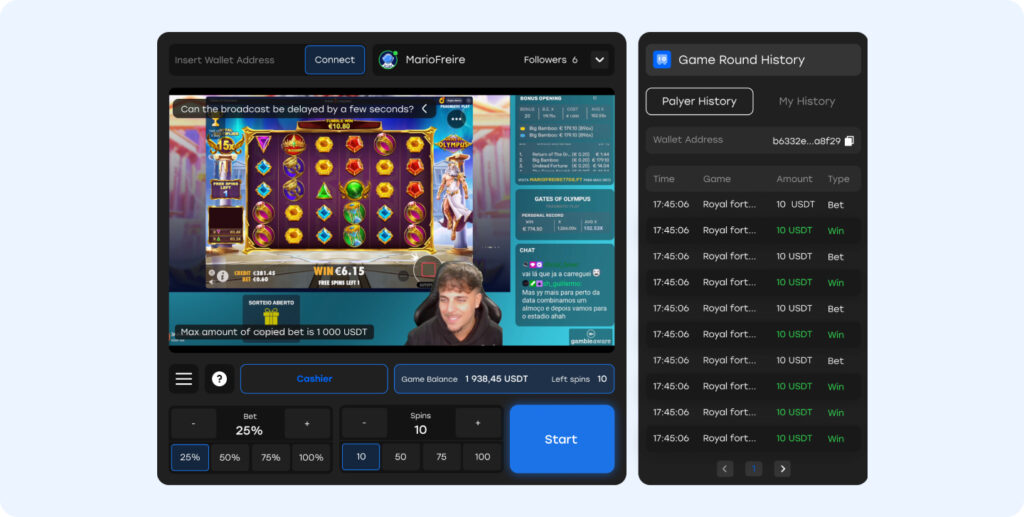

CopyStake

CopyStake is the latest addition to Trueplay’s ensemble of retention tools. It is social gaming at its finest, allowing customers to “copy” the bets of their favorite streamers automatically. All they need to do is pick a streamer to copy, select an amount, set the number of spins, and voilà, they’re replicating bets in no time.

This feature is of particular value for brand partnerships and influencer marketing. These popular personalities have the means to bring their entire community to a brand’s platform. They can also have fans returning regularly.

Fig. 8: CopyStake

Marketing Campaigns

The final Trueplay feature is marketing campaigns, a means to reward user actions that platforms find important. These can be anything from registration and completing their KYC to taking surveys and participating in special events. Marketing campaigns are often the first aspect of loyalty programs players encounter on iGaming platforms. This makes them a stalwart mainstay in the iGaming industry.

Fig. 9: Marketing Campaigns

The Benefits of Trueplay

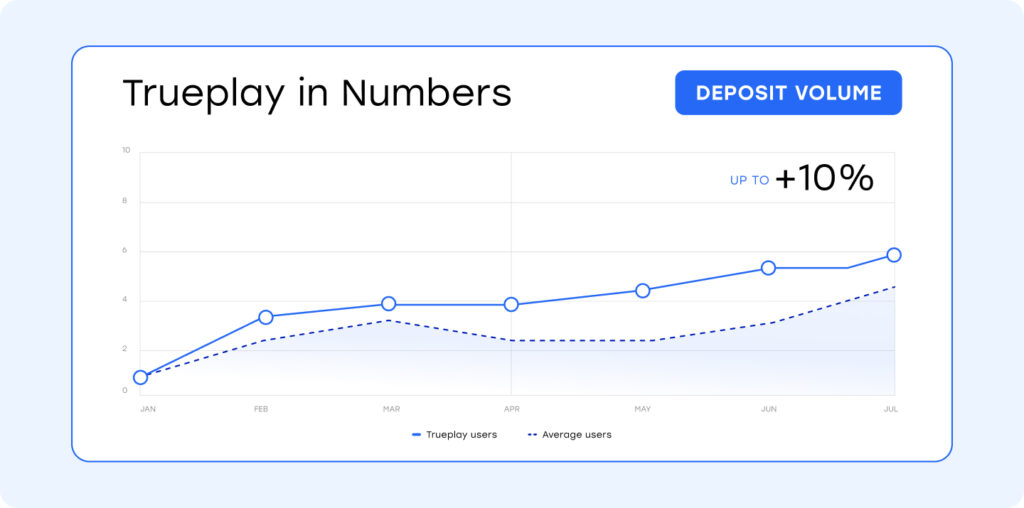

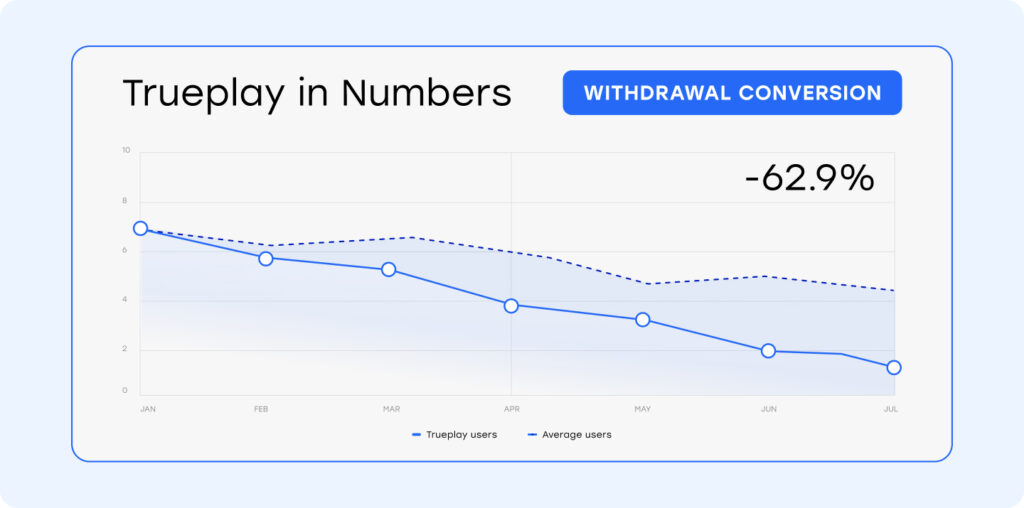

Together, these features make up a single solution that will boost a platform’s growth and retention quickly. Brands that adopted Trueplay have achieved a net gross revenue (NGR) increase of up to 5.6%. Platform withdrawals have dropped to 62.9%, ensuring players continue to spend time on them. Meanwhile, deposits have grown by up to 10%. What makes these figures even more enticing is that they represent only the first six months of using Trueplay.

Fig. 10: Trueplay NGR Uplift

Marketing campaigns attract new players, while Hold to Earn and Play to Earn boost retention and increase user visits. CopyStake enhances player cash flow by encouraging numerous players and streamer communities from around the globe to play together. They do so simultaneously, as often as they like.

Fig. 11: Trueplay Deposit Volume

Additionally, Trueplay’s solution puts security and transparency at the forefront of its offering. It achieves this through Explorer, a platform that provides live data from the Trueplay network for verification. The rise of the internet has also unfortunately led to mistrust and misinformation, which is why Explorer exists. It is an insurance policy against naysayers.

Fig. 12: Trueplay player cashflow

To demonstrate the impact of loyalty programs on brand revenue, let us revisit the stats on cash flow. Platforms that used Trueplay saw immediate results, with profits running from $45,399.54 over month one to $62,777.84 by month six. This difference in average revenue displays one way the adoption of loyalty programs can ensure a brand’s rapid growth in the global iGaming market.

Fig. 13: Trueplay withdrawal conversion

Insider Thoughts

This iGaming market report would not be complete without the opinions of industry experts, whose insights offer valuable perspectives on trends, challenges, and the future of iGaming.

What major challenges do you anticipate for loyalty programs within the iGaming industry in 2024?

The major challenge for an iGaming operator will always be “the same tea — different cup.” An operator can keep a player committed as long as it is a great game session — but what next? We have created a unique solution that will keep players committed to the brand even after a bad hand.

What strategy would you recommend to a business with poor retention?

Understand where the issues lie and be true to yourself. Would another 30 free spins or an extra email to your inbox be appealing to you? Be different, try unique and data-based alternatives, and most importantly — stay true!

Do you expect gamification to remain a major trend in customer loyalty for the foreseeable future?

As far as trends have shown us, gamification will remain one of the best tools to use, coupled with great marketing to keep your customers loyal to your brand.

Name one new feature that has appeared recently in iGaming loyalty.

Trueplay’s “CopyStake,” which allows players to follow their favorite streamers and bet alongside them, is definitely a game changer.

How does Trueplay’s gamification strategy incentivize player loyalty?

Everything we do here is aimed at making players more loyal and interested in spending time and money on a brand, instead of just jumping from one place to another. This we achieve through a unique reward system that allows players to earn as the brand earns.

How do you convince potential clients who are skeptical about the ROI of loyalty programs?

Show them the results of our existing clients.

iGaming in 2024 Is Just Warming Up

As the year progresses, iGaming brands remain optimistic about achieving their projected market volume, especially given the high expectations the first quarter brings. Implementing an effective loyalty program can be crucial for forward-thinking platforms aiming for success. Analyzing market trends enables these platforms to pinpoint areas needing enhancement and to align their retention strategies more effectively.

The iGaming industry’s growth, propelled by continuous technological advancements and market trends, promises the evolution of loyalty programs. Brands adopting solutions like Trueplay have seen substantial growth, highlighting the potential benefits for those yet to explore such strategies. Embracing creative loyalty solutions like Trueplay can be a game-changer, strategically boosting revenue and enhancing user engagement.